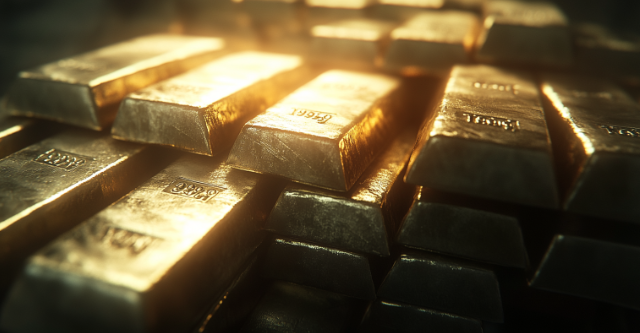

Rising gold prices recently sparked concerns among investors. This increase went beyond market shifts and highlighted deeper worries about inflation and economic instability. Amid rising uncertainty, many are turning to this valuable asset as a safe haven to preserve their wealth and ensure long-term stability.

But Why Are Gold Prices Rising?

The fact that gold isn’t tied to any country or currency makes it a safe bet during uncertain times. When inflation reduces purchasing power, this precious metal becomes a reliable way to preserve wealth. The high living costs in the U.S. and other major countries lessen the worth of stocks and bonds and led investors to turn to this tangible asset instead.

With the U.S. facing huge debts and price hikes, many people began questioning the dollar’s strength. And when things start to get shakier, the government responds by printing more money which then further weakens the dollar.

Inflation and the Falling Value of the Dollar

Inflation reduces money’s purchasing power and makes it harder to maintain wealth. Since governments can issue more money, gold remains a more valuable physical asset due to its limited supply.

Since COVID-19, increased government spending also weakened the dollar. As inflation rises, more people turn to gold to protect their savings. This precious metal can reliably safeguard wealth when money loses value.

The History of the Gold Standard

Gold has been a trusted asset for centuries. Historically, countries tied their money to gold reserves, a system called the gold standard. This ensured that paper money was backed by real gold. In the 1970s, the U.S. dropped the gold standard due to rising oil prices and economic problems. Since then, currencies have been backed by trust in governments. However, gold remains a trusted asset, especially in times of instability.

What is a Safe Haven Asset?

Safe haven assets are investments that tend to hold or increase their value when markets are volatile. In addition to gold, other precious metals like silver and platinum are also considered safe havens. These metals are not only valuable but also have industrial uses. They add another layer of demand that can help stabilize their value during economic downturns.

Global Power Shifts

The growing demand for gold also reflects global power shifts. The U.S. has long dominated the world economy with the dollar as the main currency. However, China and Russia are increasing their gold reserves while distancing themselves from U.S. financial systems.

These countries expressed their worries about U.S. financial stability. To protect their economies, they reduced their reliance on the dollar and increased their gold reserves instead. They see this valuable metal as a way to stay safe from sanctions, trade wars, or financial distress.

For instance, China continues to push the yuan to compete with the dollar.. On the other hand, Russia stockpiles gold to protect itself from Western sanctions.

The Rise of BRICS and the Challenge to the Dollar

A group of emerging economies known as BRICS (Brazil, Russia, India, China, and South Africa) has been working together to reduce their reliance on the U.S. dollar. They aim to create an alternative to the current dollar-dominated global system. While replacing the dollar as the leading currency would be challenging, BRICS’ actions reflect growing dissatisfaction with the traditional financial system. These nations are preparing for changes by boosting their gold reserves.

What Does This Mean for Investors?

Gold has always seemed like a safe investment during economic challenges. For everyday investors, this surge offers both opportunities and risks. If you’re worried about inflation or market swings, investing in this precious asset might help protect the value of your money. However, its price can fluctuate in the short term. Investing without tracking the market could result in losses especially if you buy at high prices.

What’s Next?

The rapid increase in gold prices reflects growing fears about inflation, global unrest, and power shifts between major countries. This timeless asset may offer security, but it also sends a message that trust in the traditional financial system is weakening.

Don’t wait for the next market shift. Learn more about gold and how it can protect your financial future.

Want to stay ahead of the market? Click here for more expert tips on navigating rising gold prices and protecting your wealth.